10 Mistakes to Stop Making in Your Lead Follow-Up

14 min

Executive summary

This guide outlines the top 10 mistakes B2B marketers make in lead follow-up and provides actionable strategies to improve conversion outcomes and accelerate sales pipeline velocity. Focused on aligning sales and marketing teams, enhancing personalization, and applying buyer insights, this article serves as a roadmap for creating high performing outreach strategies. It covers how:

Explore the full article to optimize your lead follow-up processes with personalization, repurposed content, and alignment best practices for faster, higher-quality conversions.

Effective lead follow-up is a vital element of maintaining and growing revenue streams, given its focus on motivating conversions and maximizing client lifetime value (CLTV).

According to the 6sense Buyer Experience report 2025, B2B buying groups average 10 members, with sales cycles lasting up to 10 months. This places a greater emphasis on detailed lead follow-up strategies that accompany prospective buyers throughout their buying journey.

The most effective way to frictionlessly nudge buyers onward is to evaluate buyer and demand intelligence to ensure the right buyers are followed up with the right message at the right time. The goal is to build a relationship of trust without needlessly adding to your prospect’s inbox.

“Effective lead follow-up requires integrating demand intelligence across buyer personas, intent signals, and behavioral data. This enables organizations to identify precise engagement opportunities within buying groups rather than treating prospects as isolated contacts.

Intelligence-driven follow-up aligns messaging with each stakeholder's unique challenges and timing, building trust through relevance and guiding buying groups toward conversion with greater clarity.”

CMO, INFUSE

What is lead follow-up?

Lead follow-up refers to the systematic process of contacting prospective buyers who have demonstrated an interest in a brand and its solutions but are not yet ready to complete a purchase. Measuring this interest is achieved with lead qualification and lead scoring based on specific actions completed by B2B prospects.

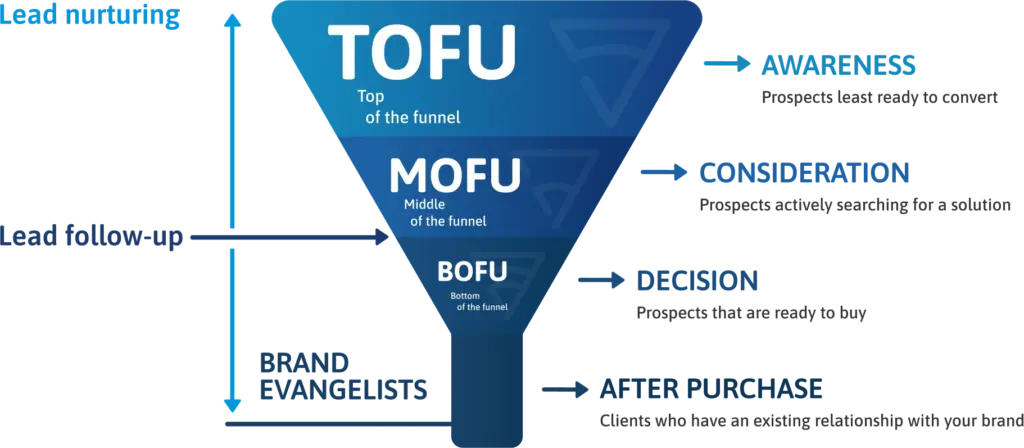

Lead follow-up strategies intend to build trust and strengthen relationships with prospects to motivate them to progress through the sales funnel toward a conversion. Successful lead follow-up results in higher CLTV and supports other initiatives for improving retention, such as brand evangelism.

What is the difference between lead follow-up and lead nurturing?

While both lead nurturing and lead follow-up strategies are designed to encourage prospective buyers to progress through the sales funnel, the two approaches differ in terms of timeline and the stage they are activated in the buying journey.

The B2B buying journey

The increase in buyer scrutiny has, in turn, complicated the buying journey, making it more demanding for key stakeholders facing pressure to drive value for their business priorities. For this reason, modern buyers now hold greater control over the purchasing process.

According to the INFUSE Voice of the Buyer 2025 report, 75% of buyers prefer a sales representative-free experience, and 70% conduct their own research independently. In fact, 80% of seller conversations are still buyer-initiated (6sense).

Considering this complexity, lead follow-up strategies must be carefully developed utilizing precision demand intelligence to drive the best results.

With that in mind, this article explores the ten most common pitfalls to avoid when developing and implementing your lead follow-up strategy:

The top 10 lead follow-up mistakes to avoid

Combining data insights can help to inform detailed strategies that address key pain points and priorities for prospective buyers. This, in turn, will support driving engagement throughout the entire buying group at target accounts.

When prioritizing B2B prospects to pursue with follow-up initiatives, dividing them into the following three categories based on lead scoring can be valuable for informing your approach:

Prospects that are considered ready to buy based on demand intelligence

Prospects that have demonstrated intent, but are not quite ready to buy

Prospects that have not demonstrated intent signals or are the wrong decision maker for targeting

While these segments can be helpful, it is important to avoid cherry-picking prospects as this can result in cold or even warm prospects becoming neglected and opportunities lost.

Utilize demand intelligence to ensure the right prospects are targeted, based on their role in the buying group, place in the buying journey, and readiness to buy.

Key sources of demand intelligence include:

Based on your findings, develop content that appeals to your target prospect’s interests, needs, and challenges. These can be in the form of:

Long-form content pieces hosted on your website that branch into other relevant content pieces to encourage prospects to spend more time on your website.

A collection of content on your website, often in the form of educational content that assists buyers in their research

An opportunity to promote brand awareness and target content according to your prospect’s needs and challenges

Tools such as ROI calculators and free demos help prospects with decision making and reaching consensus

A top-performing medium for displaying information in an interesting or engaging way, and to break up large bodies of text for easy digestion

Infographics can be used to break down processes or complex ideas into simple, accessible views

Consider on-demand webcasts that enable prospects to view educational or thought leadership content in their own time and at their own pace

Provides more in-depth detail on topics of interest, supported by statistics, research, and best practices

Below are two examples of how lead scoring and demand intelligence can be combined to create accurate strategies for engaging high-value accounts:

Lead 1

Lead 2

Job title

IT Manager at a mid-market business

Chief Marketing Officer at a tech enterprise

Lead score

Medium

Low

Demand intelligence

While this prospect is engaging with marketing efforts, their job title indicates that they are not a key decision maker at the target account.

However, they may have the potential to influence buying decisions made by the committee.

This prospect is a decision maker in the buying group of an organization that is a good fit for the brand’s solutions.

However, they are currently partnered with a competitor and have a contractual obligation.

Strategy

This prospect, while not a member of the buying group, should continue to receive lead nurturing.

The brand should implement follow-up strategies once the prospect demonstrates greater buyer intent. This should include valuable resources and insights that encourage sharing with decision makers at the target account.

This prospect represents a high-value account despite its low lead score.

Given the potential, the brand should deploy a competitive displacement program to generate demand before executing any follow-up strategies.

Harnessing the latest demand and buyer intelligence at your disposal is essential. Ensuring data efficiency will enable you to segment prospects as needed to inform the customization and performance of your lead follow-up campaigns.

However, be sure to regularly update your lead database. Your solutions are likely to evolve as you navigate market trends and fluctuations in buyer behavior. As a result, assessing and revising how B2B marketing prospects are reviewed will help you adapt strategies with greater accuracy to combat any challenges and developments that present themselves.

Below are some examples of how your database should be updated in order of specificity:

Firmographic and demographic data that indicate a business that is most likely to benefit from purchasing your solutions, including:

A buyer persona is a fictional representation of key stakeholders at your ideal target accounts.

Data to consider updating:

A combination of buyer persona, segmentation, buyer intent, lead scoring, and behavioral data points, collected from campaign performance reports.

Examples:

Be mindful of your prospect’s time and ensure all follow-up is guided by their signals. This process is crucial, especially given the emphasis buyers place on high-quality, personalized buying experiences.

Creating a sense of urgency is no longer effective in the face of today’s scrutinous buyers who are navigating complex buying journeys. Rushing a prospect toward a sale before they are prepared, or able to do so, will not only result in churn but also damage any trust established through demand generation efforts.

Instead, prioritize building a stronger relationship with prospects to lay the foundation for relevant lead follow-up and other outreach strategies.

Aside from lead nurturing, here are two other approaches to consider:

To ensure that prospects are handed over to sales teams for follow-up at the right moment, lead scoring processes can be bolstered with triggers. These can be specific actions you have identified through successful campaigns to indicate strong buyer intent.

For example, prospects generated via different channels cannot be considered to have the same levels of intent. A prospect completing a contact form on a gated whitepaper is unlikely to have the same interest as one who has completed similar fields on a product demo page.

Timing is everything. Understanding the optimal frequency and time of day to reach out to prospects is crucial for yielding the best results from campaigns. However, this is also likely to fluctuate according to the factors influencing engagement with outreach (outside of messaging, etc).

Here are some best practices to keep in mind when scheduling lead follow-up cadences:

Orchestrating the best timing, both in terms of day of the week and time of day, and lead score will naturally evolve as you gather more data insights on prospect behavior.

For lead follow-up to be effective and resonate with prospective buyers, it is crucial to personalize demand programs as much as possible.

Any messaging that can be interpreted as derivative is unlikely to perform well. After all, relevance is key as buyers expect to have their needs understood and met.

Therefore, messaging is another core area of lead follow-up that should be informed by demand intelligence. Feedback from your sales teams can be particularly valuable for helping you shape messaging that tackles objections and highlights solutions to pain points in a way that resonates with B2B buyers.

Combine findings with the performance of marketing campaigns at the top of the funnel to identify the messaging that is best suited to each stage.

Consider implementing Account Based Marketing and Experience (ABM, ABX) strategies for accounts that represent high-value opportunities and match your buyer personas and ICPs. While a resource-intensive approach, hyper-personalized campaigns have a greater potential to yield better results.

Channel diversification is not only a powerful strategy for tackling channel fatigue, but also an effective way to demonstrate your understanding of your prospect’s unique preferences and needs.

For example, when implementing follow-up strategies, consider activating outreach across a blend of marketing channels, such as email, social media, and mobile. Like all other elements of your follow-up efforts, inform your channel mix based on the data insights you have available to you.

Although follow-up is a shorter process than nurturing, you can adopt nurturing best practices to capitalize on your channel mix. This involves alternating between channels and allowing for breaks between outreach cadences on each. For example, email follow-up can be enriched with touchpoints on LinkedIn, assuming that a connection has already been established with the prospect on this platform.

Depending on the engagement generated, you will be able to identify priority channels to invest more in and others to remove from your channel mix to ensure optimal results.

As defensive buyers are required to navigate an increasingly complex buying journey, content can be an effective tool for demonstrating the business value your brand provides and for providing the information required for buying group members to reach consensus.

As an extension of your brand voice, expertise, and therefore image, content needs to be of high quality and accurate to its audience’s needs. In this case, the varying interests, challenges, and pain points of the various stakeholders that make up the buying group at your target account.

Content performance can also be supported by matching the type of content shared with the right buyer persona and across the right channel. When it comes to follow-up, consider sharing content best suited for prospects in the lower stages of the funnel, and in the format that matches their preferences.

Here are some examples:

Consider repurposing your content to match the strength of the channel you are distributing it on to support its performance. For example, case studies can be repurposed into one-pagers that highlight the principal features or data points that are most likely to be of interest to the recipient in question. Similarly, webinars represent a great opportunity for repurposed content, as they can be cut into short clips of key moments (especially suited to social platforms such as LinkedIn).

Align this strategy with your content marketing roadmaps to ensure that your sales teams have a consistent stream of up-to-date sales enablement materials for outreach and follow-up strategies.

In essence, providing B2B marketing prospects with valuable content in your follow-up can be an effective way to establish and strengthen relationships that will support conversions.

Given the importance of delivering seamless, highly personalized experiences for buyers, achieving alignment (a common challenge for many) is necessary for yielding the best outcomes.

Communication is key. Lead scoring, nurturing, and follow-up are all processes that require constant adjustment to ensure their accuracy. Therefore, establishing a single framework for sales and marketing teams and sharing feedback from both sides of the process can help to inform optimization and encourage teamwork.

These team syncs can also address joint KPIs and strategize tweaks to workflows (such as lead handover between sales and marketing), as well as new campaigns based on the latest data insights available.

Simple efforts allow teams to work off a strong foundation, enabling more innovation, a higher-quality buyer experience, and a greater likelihood of achieving performance goals as a result.

Investing more time with prospects on a more personal level can help to drive lead follow-up performance.

In the pursuit of high-value target accounts, it is easy to lose sight of the more personal, human element of sales; however, prioritizing this is often key to securing higher CLTV by setting up a stronger basis for repeat business.

As explored in other aspects of this guide, providing prospects with value and demonstrating a keen understanding of their challenges and ambitions is crucial for successful lead follow-up. This act of “making deposits” by sharing valuable information or resources accurate to buyer needs can be made more effective with a more “human” approach in the language you employ.

Avoid industry jargon that dilutes your message and detracts from the value proposition in your follow-up. Engaging prospects with honest, humble, and humorous messaging (as appropriate) can enable prospects to build trust with you and your brand as an extension. Straightforward outreach supports demand generation by humanizing your brand and bringing the value of your solutions to the forefront.

Finally, a critical element of your lead follow-up strategy is identifying when to stop contacting B2B prospects.

After all, while it is important not to disregard prospects that have the potential to drive significant value for your business, misplaced persistence has the potential to waste opportunities to engage those who are currently not in the market.

In the case of no engagement with a series of touchpoints, consider pausing follow-up altogether or re-routing prospects into personalized nurturing streams to maintain interest. This helps to avoid churn and accounts for the influencing factors that may explain an apparent “loss of interest” from the prospect’s side.

Another strategy to consider is addressing this drop in engagement with the prospect directly with a closed-loop process. This can be a straightforward yes/no question or a light-hearted email with options for indicating their level of interest, a short video message, or a unique offer.

This can not only help to inform your next steps, but it also differentiates your brand from a more generic action, or lack thereof.

Remember, a high percentage of B2B marketing prospects with low engagement may be symptomatic of errors in your targeting.