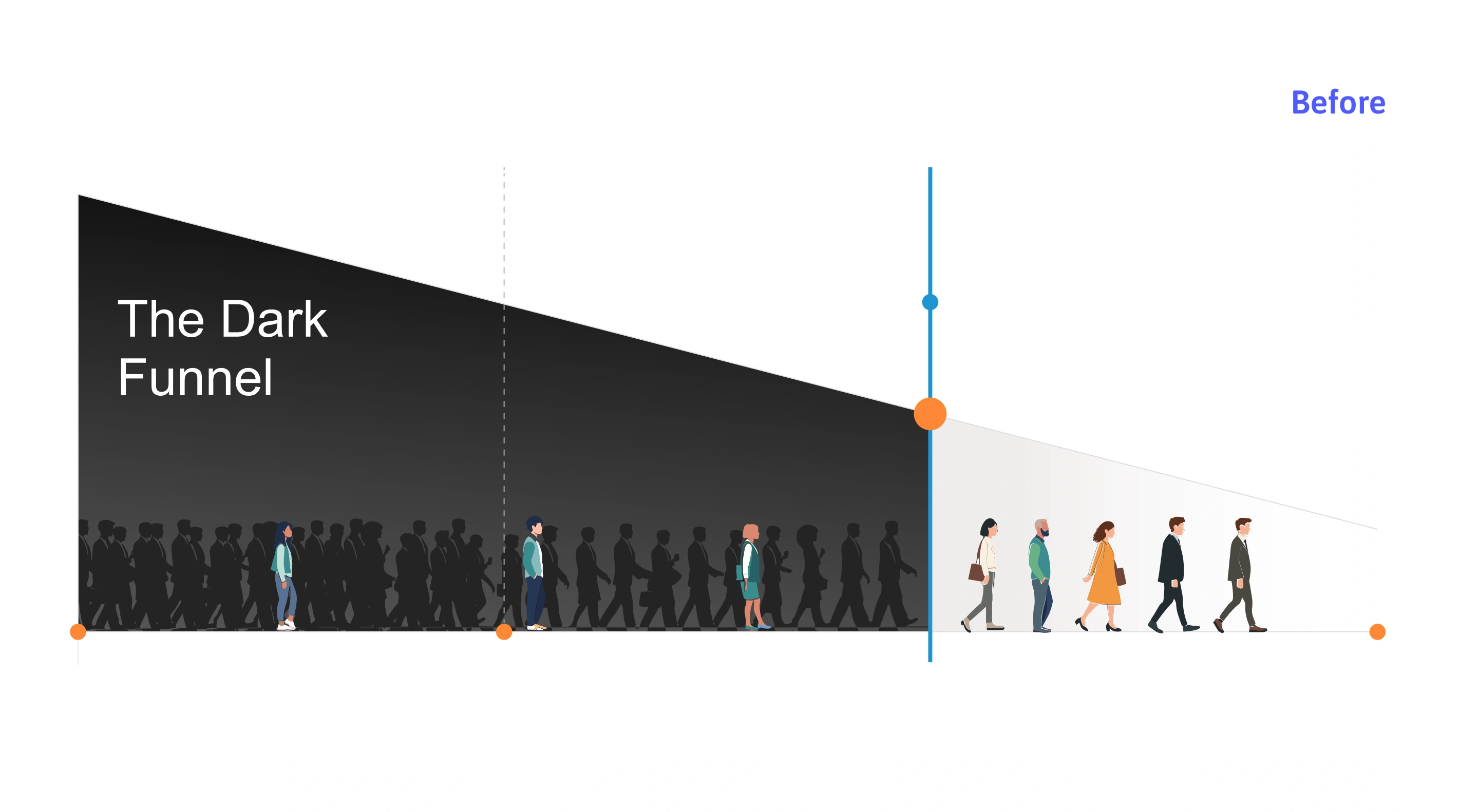

GTM teams face an implementation challenge: rapid adoption of AI solutions has not translated into clear, quantifiable outcomes.

According to INFUSE Voice of the Buyer 2026 research, 58% of buyers prioritize “strong alignment” with their use case or technical requirements when creating vendor shortlists, while 36% cite “demonstrated ROI.”

In other words, buyers mitigate risk in their purchase decisions, prioritizing applications that seamlessly integrate with their tech stack and deliver proven performance. Vague or aspirational promises damage buyer confidence, stalling decisions, and can even result in solutions being removed from consideration.

Buyers seek vendors they can trust not only to solve their current problems but also to mitigate future challenges as they arise.