Voice of the Buyer 2026

3 min

Introduction

Our fourth annual INFUSE Insights Voice of the Buyer report examines a market entering the era of the trust gap. B2B buyers have never been more empowered: AI-assisted research, expanded peer networks, and unprecedented access to information. Yet confidence in purchases continues to erode. Our survey of 2,300+ B2B GTM leaders reveals that information abundance has not translated into clarity, but has widened the gap between what buyers know and what they trust.

These findings demand a shift in go-to-market (GTM) strategy. Buying cycles compress while buying groups expand, and AI has moved from experimental curiosity to operational necessity. Brand preference continues to crystallize in the dark funnel, accelerated by AI, before vendors detect any signals.

The organizations positioned to win will enable decision making rather than amplify complexity.

This year's Voice of the Buyer research covers:

Research themes

The AI imperative requires operational discipline

Buyer confidence crisis creates a buyer trust gap

Execution is the new GTM strategic advantage

Region

Audience overview

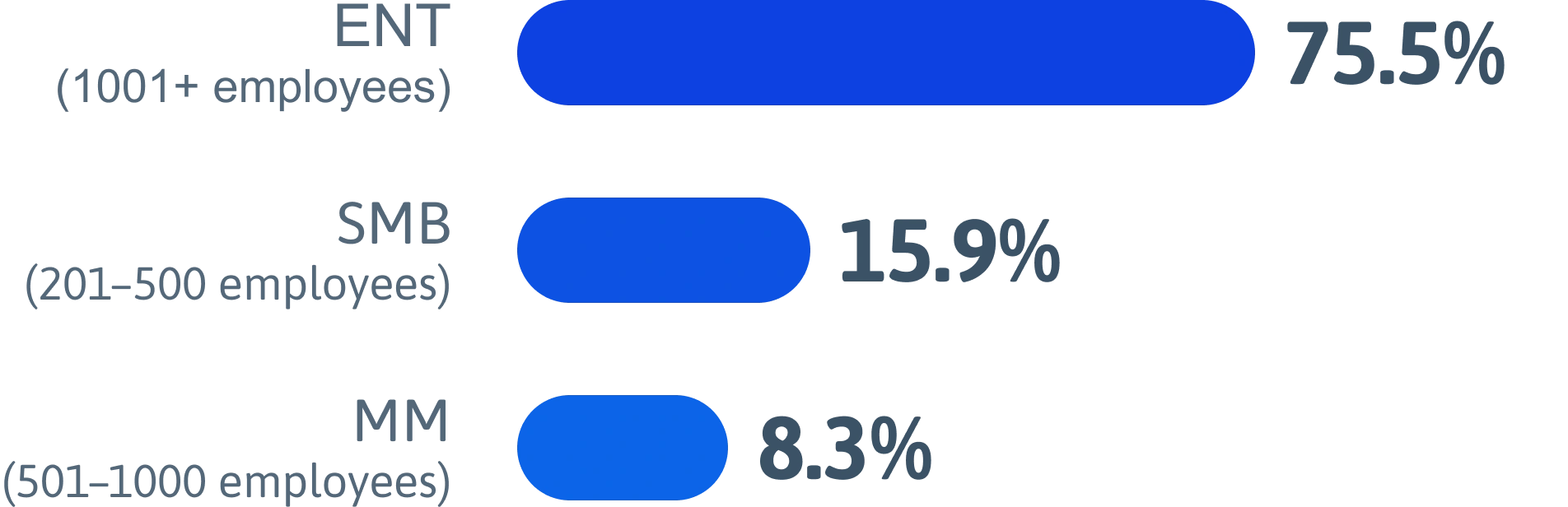

Organization size

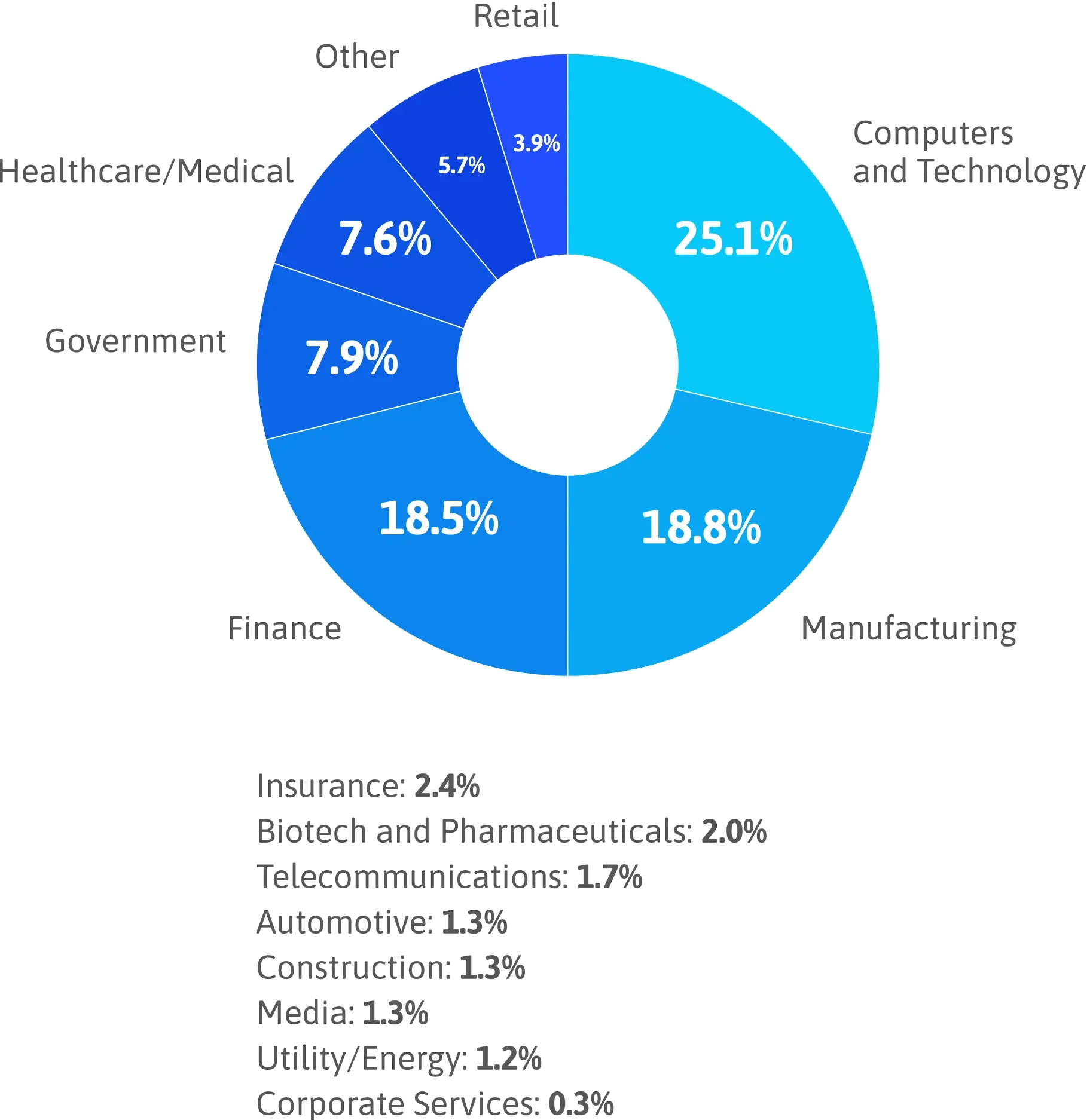

Industry

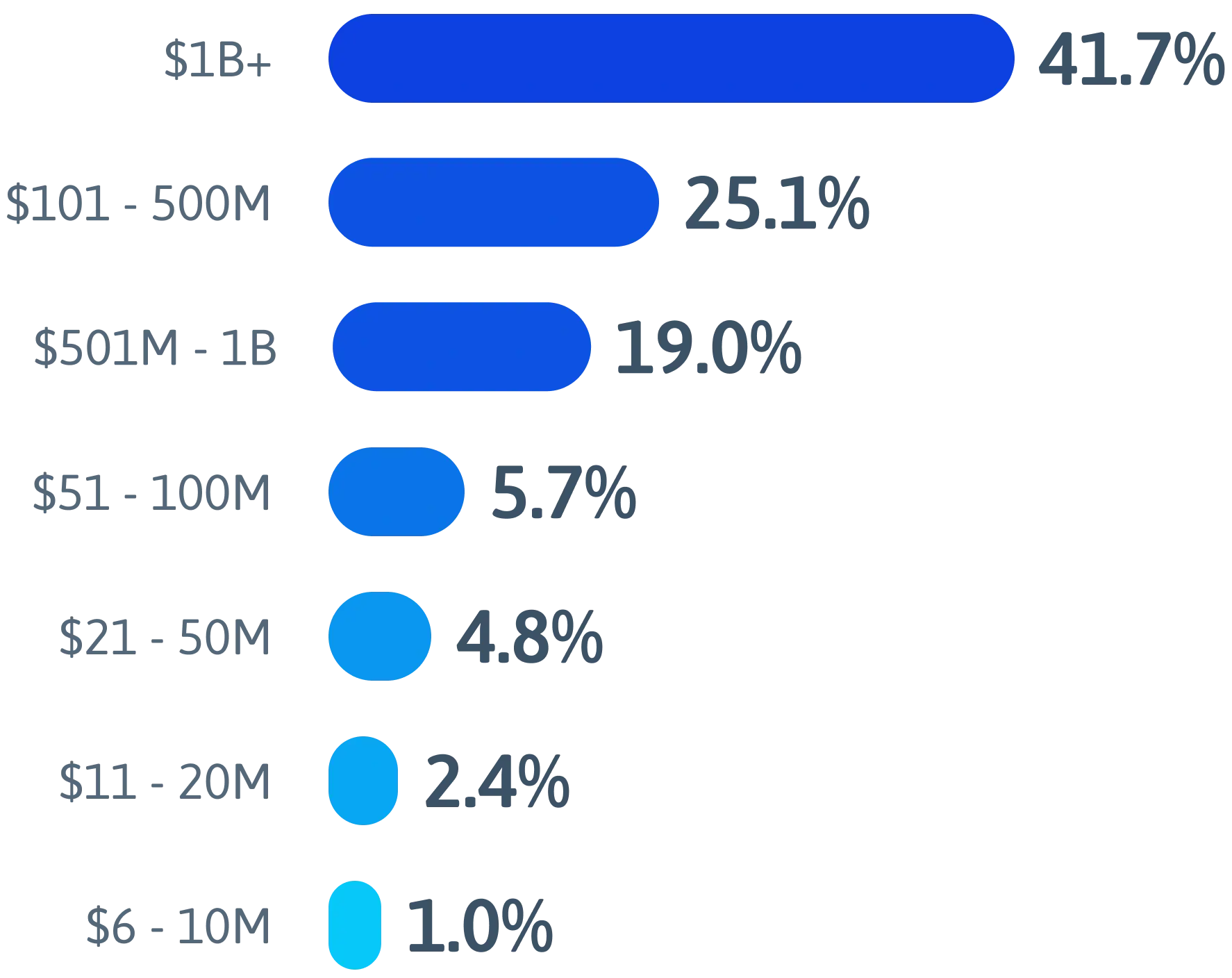

Annual revenue

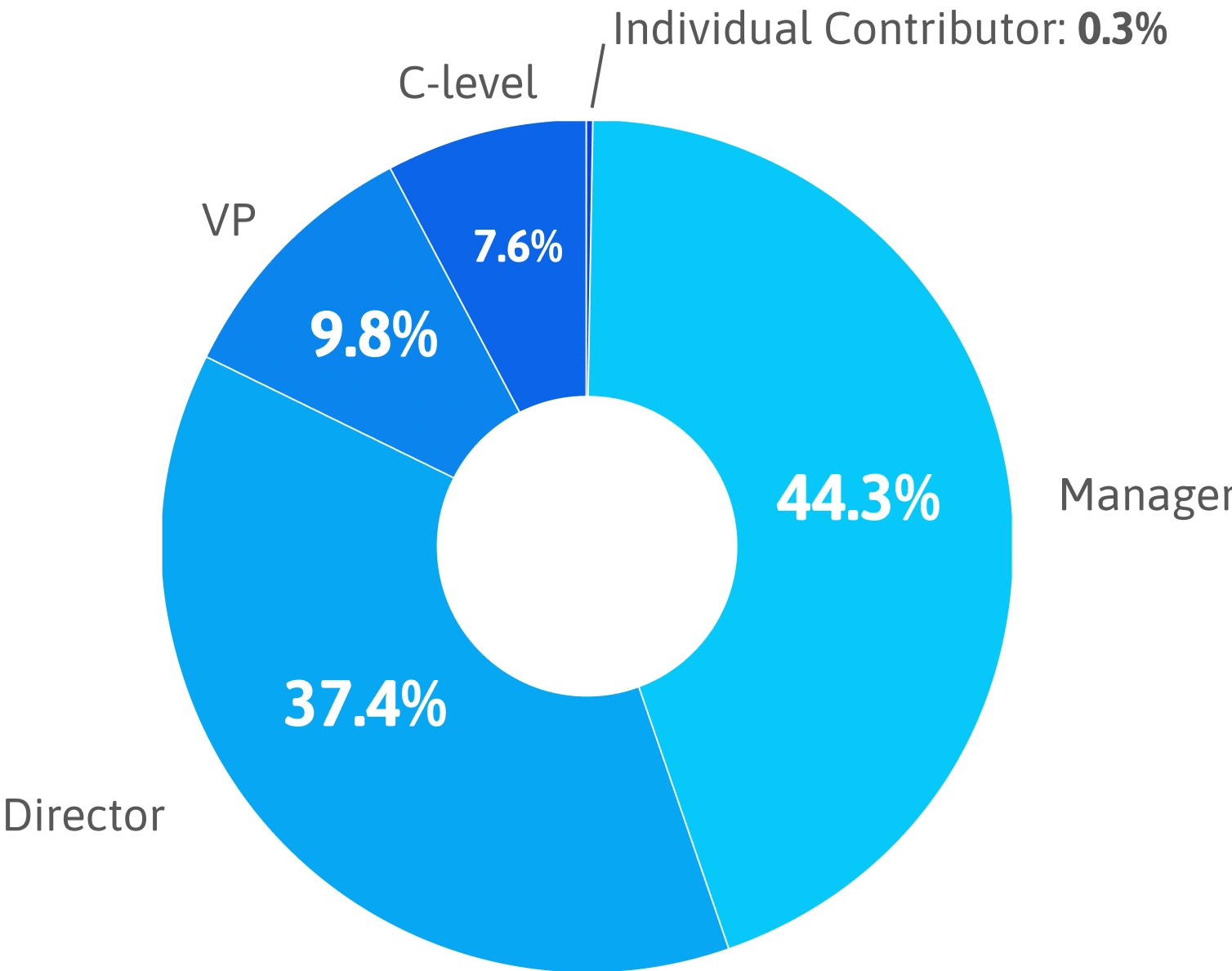

Seniority

The AI imperative requires operational discipline

AI adoption has become a race for buyers and sellers alike. Buyers are using AI to accelerate their research and evaluation timelines, compressing months into weeks.

This velocity demands vendors to clearly demonstrate value, answer questions with precision, and prove integration capabilities faster than ever. Execution is now the core differentiator.

Business enablement, not vanity metrics, dominates tech investment objectives

What primary outcome do you want to achieve from your technology investments in 2026?

2025

2026

Operating Efficiency

41%

31%

Revenue Growth

17%

20%

Customer Experience & Engagement

10%

16%

Business Transformation; Strategic & Competitive Advantage

7%

12%

Employee Productivity & Enablement

7%

11%

Risk Management & Compliance

6%

10%

Operating efficiency leads, but revenue and customer experience gain ground: Operating efficiency leads at 31% (down from 41% in 2025), while every other outcome grows in priority. Revenue growth is up to 20% (from 17% in 2025), customer experience surges to 16% (from 10%), and business transformation climbs to 12% (from 7%).

This redistribution signals a shift in AI deployment strategy. Organizations have moved beyond experimental projects to pursue revenue-generating applications. The diversified priorities of 2026 reveal strategic AI integration across all business functions.

Takeaway

GTM teams must reframe AI messaging beyond “efficiency.”

Technology positioned solely around cost reduction and process optimization misses the strategic imperative driving 70% of investments.

GTM teams should position AI around impact, not automation, by tying use cases directly to revenue creation, buyer progress, and measurable performance gains.