The Dangers of Only Focusing on Bottom of Funnel Prospects

15 min

Executive summary

Many B2B organizations over-prioritize bottom-of-funnel (BOFU) leads, chasing a small portion of in-market buyers while neglecting the vast majority of prospects who could become future opportunities. This short-term focus creates blind spots, inflates Client Acquisition Costs (CAC), and slows group consensus in today’s longer and more complex buying journeys.

This article examines the risks of BOFU-only strategies and outlines how demand generation builds revenue impact by enabling buying groups across every stage of their journey.

Discover how shifting from a BOFU-only mindset to a full-funnel, buyer-centric approach protects revenue, accelerates consensus, and drives sustainable growth.

Focusing exclusively on bottom-of-funnel (BOFU) prospects may feel like the fastest path to revenue. However, considering the complexity of current B2B buying journeys, it is a strategy that holds unnecessary risk.

According to a study published by LinkedIn’s B2B Institute, only about 5% of a TAM is actively in-market at any given time, leaving 95% of potential opportunities ignored if you place too much focus on late-stage demand.

Critically, it is not only individuals making buying decisions anymore. Buying groups are larger and more complex than ever, with mid-market deals often involving 4-10 people and enterprise deals requiring 15+ stakeholders to reach consensus (Voice of the Buyer, 2025).

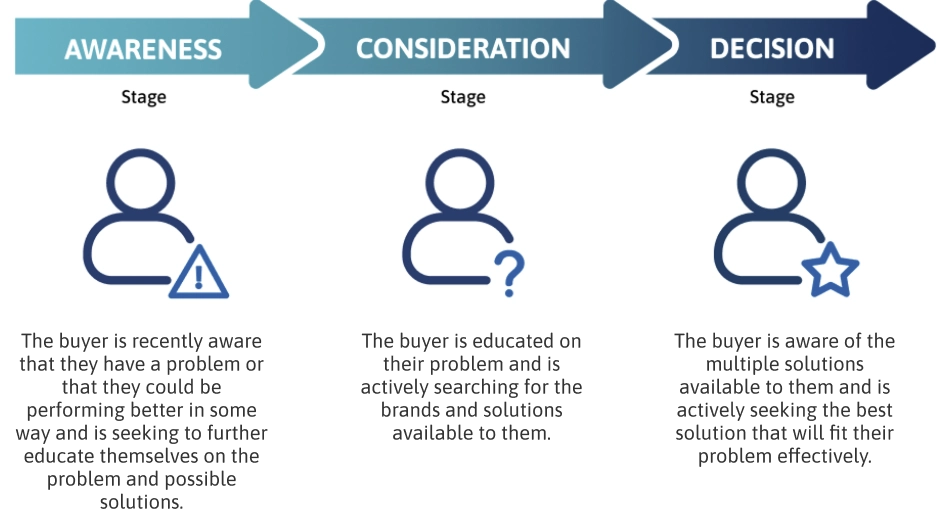

The real danger is not simply “BOFU obsession” but neglecting the reality of how modern buying groups operate. When an account enters the buying journey, new members join at different times, often entering through TOFU or MOFU.

As a result, there are always stakeholders at the awareness stage, even as others progress toward a decision. To accelerate account progression, organizations should create strategies that engage each member of the buying group at the moment they enter, equipping them with content, insights, and experiences that keep the entire account moving forward.

Modern demand generation is not about the individual; it is enabling buying groups across the full journey.

This requires shifting resources away from prospect-scoring quick wins and toward strategies that build trust, reduce friction, and create consensus from the first touch through the final purchase decision.

Why is a full-funnel strategy important in modern demand generation?

Chasing the small portion of BOFU buyers who are “in-market” can limit growth. The most effective organizations build strategies that engage the other 95% of the market by creating demand, enabling buyers, and nurturing trust long before a sales conversation begins.

According to Gartner (2023), over 80% of the B2B buying journey now happens in digital and self-directed channels, without direct sales involvement. Aligned with this statistic is the fact that 70% of the modern buyer journey takes place in the dark funnel, the early phase of research before a prospect makes their intent known (6sense, 2024).

This makes top and mid-funnel demand generation essential for shaping buyer perception, delivering value early, and fueling pipeline with sales-ready opportunities. Marketing cannot afford to only focus on where sales have visibility.

Buying groups also are not static. While directors and senior managers often drive the process, Voice of the Buyer data (2025) shows that associates and managers are entering earlier in buying cycles. That means even when an account “enters” a buying cycle, different stakeholders are still at TOFU, which reinforces the need for relevant engagement across roles and stages.

Equally, engaging prospects today requires persistence and context. The average B2B buying journey now lasts nearly a year, with 22% extending beyond 12 months (Voice of the Buyer, 2025). Beyond repetitive nurturing, these journeys require orchestrated, omnichannel engagement that adapts to evolving priorities, reduces friction, and builds buying group confidence over time.

The economic climate has only intensified this need. With budgets under scrutiny, buyers becoming increasingly risk-averse, and deal cycles lengthening, marketers can no longer rely on rigid, BOFU-heavy plans. Instead, they must adopt an agile, brand-to-revenue approach that balances demand generation, engagement, and conversion to fuel both immediate opportunities and long-term growth.

The sales funnel explained

What are the different stages of the sales funnel?

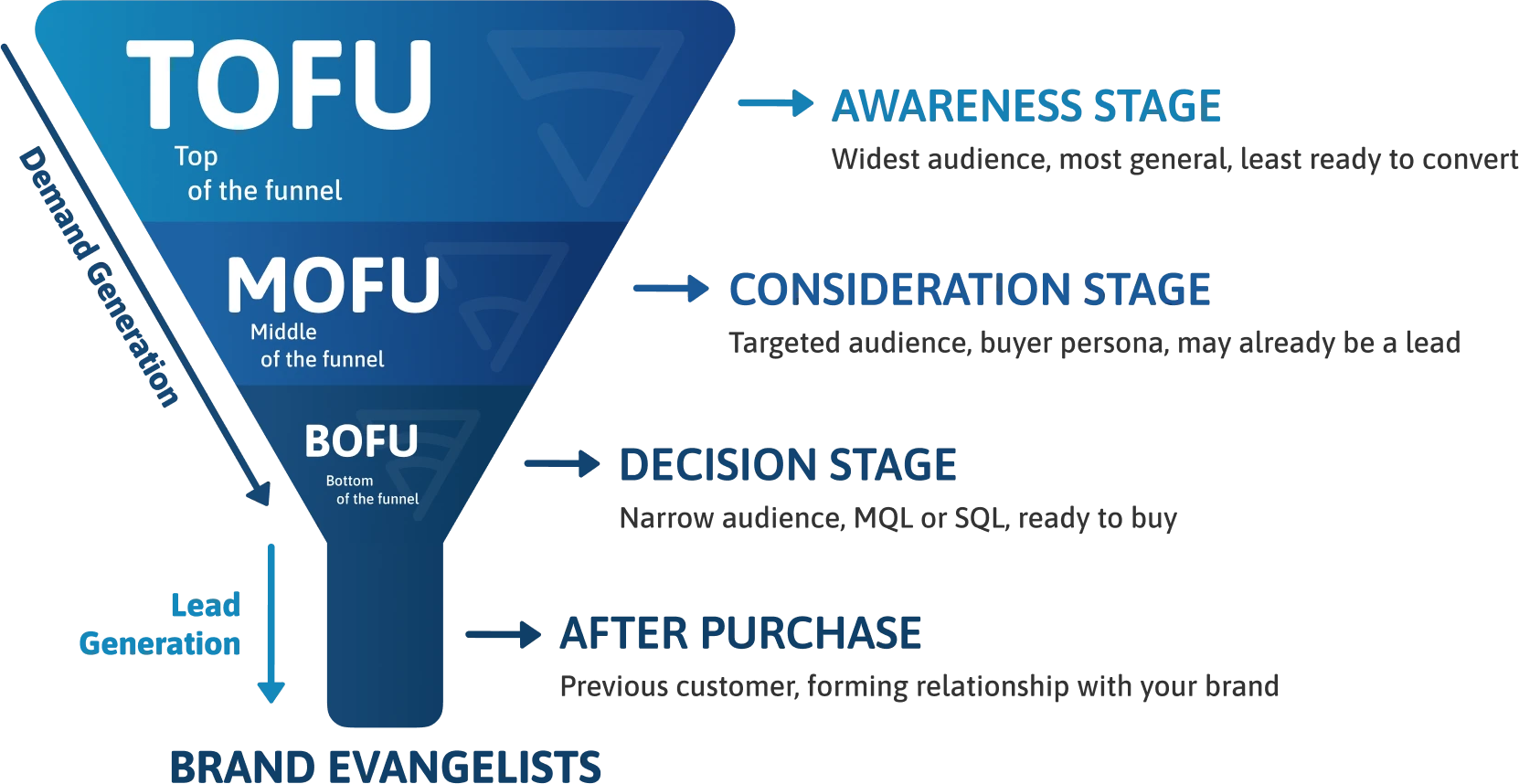

The modern sales funnel is not simply a linear model of individual prospects moving from awareness to decision. In the current state of B2B buying, TOFU, MOFU, and BOFU represent entry points for different members of the buying group. Each member enters the journey at different times, with different levels of context, influence, and priorities.

This means buying journeys must move beyond a single prospect progressing step by step to orchestrating engagement across a dynamic group that expands and evolves over time.

Stage

Description

Goal

Dark Funnel

Pre-awareness (unseen journey)

70%+ of buying activity happens unseen; brand building here drives shortlist inclusion later

Build brand presence and perceived value before visibility

TOFU (Top of Funnel)

Awareness / Problem framing

Buyers start exploring problems and solutions; early influence grows here

Create awareness, reduce uncertainty, and position the brand as credible

MOFU (Middle of Funnel)

Consideration / Solution comparison

Buyers align on requirements and evaluate approaches

Provide educational, differentiating content that connects value to outcomes and drives consensus

BOFU (Bottom of Funnel)

Decision / Validation

Buyers finalize decisions and require proof of value

Deliver ROI proof, testimonials, and validation materials to reduce risk and confirm trust

TAM (Total Addressable Market)

Market definition / Strategy foundation

Defines total revenue potential and guides segmentation into ICPs and personas

Map influence and engagement opportunities across the buying group for targeted entry

How do you identify buyer intent at the bottom of the funnel?

The 5% of your market that is actively in-market represents a critical but narrow slice of opportunity. Identifying them is not a matter of tracking individual prospects. Rather, it is about detecting signals across the entire buying group that indicate collective movement toward a purchase decision.

Intent signals play a central role here. By analyzing digital behaviors, such as content consumption, peer discussions, or solution comparisons, marketers can identify accounts showing surging interest. These insights typically come from a mix of CRM, marketing automation, and third-party intent providers, but the real value comes from how they are applied: turning fragmented activity into actionable buying group intelligence that sales can use.

Intent signals are a key factor for B2B marketers using Account-Based Marketing (ABM) efforts to prioritize accounts. However, accuracy and context matter when doing this. Not all signals mean ready to buy, and must be layered with account fit, stage mapping, and buyer role insights to avoid false positives.

This is where brand-to-revenue strategies intersect with intent. While intent helps identify the 5%, brand presence and buyer enablement build on the 5% to ensure your organization is top-of-mind when those signals emerge. Without that foundation, even the strongest intent data will not convert into revenue.

What are the types of intent signals?

Intent signals in modern B2B buying have evolved from simply tracking what one individual downloads or clicks. Now, it is about recognizing indicators that a buying group is forming and moving closer to a decision.

Below is an overview of the different types of intent signals and how they work.

Data type

Key value

Marketing use

Notes

First-Party Intent

Owned channels (website, events, content)

Shows direct engagement across stakeholders

Map actions within accounts to reveal buying group interest

The most reliable, but limited to your ecosystem

Second-Party Intent

Partner data, review sites, and content activation

Expands visibility into external research

Validates engagement across shared audiences

Extends insight beyond owned data

Third-Party Intent

Aggregated external providers

Identifies accounts actively researching solutions

Combine with fit and opportunity data to find surging interest

Reveals broader market demand trends

Buyer Enablement Context

All intent types combined

Intent must be mapped at the account level, not as linear scores

Personalize engagement by role and stage; reinforce brand trust

Intent + Fit + Opportunity = most accurate revenue signal

Strategies for calculating in-market prospects within the bottom of the funnel

Pinpointing the small portion of “ready-to-buy” prospects of your TAM is all about recognizing when a buying group is signaling readiness as a collective.

The following strategies can help marketers identify this critical segment more accurately and in a way that drives revenue impact.

- Surface dark funnel activity: Use social listening, review monitoring, share-of-voice, and web analytics to uncover hidden account engagement

- Align all data signals: Combine first-, second-, and third-party intent for a multi-dimensional ABM view across personas and channels

- Audit and refresh data: With buyer journeys averaging 11.5 months and 22% lasting over a year (Voice of the Buyer, 2025), regularly validate data to keep insights current

- Combine intent with fit and opportunity: Layer ICP alignment, tech stack, budget, and leadership signals to distinguish real purchase potential from mere interest

6 risks of targeting only BOFU prospects

Focusing exclusively on the small slice of prospects that are late-stage and in-market may look efficient, but it creates blind spots that erode long-term pipeline health and revenue growth.

Here are the core risks of minimizing your focus to in-market prospects only:

1. Wasted budget on the obvious few

BOFU-ready accounts already show strong intent signals and typically require less persuasion to progress. Over-prioritizing your budget on this narrow segment inflates CAC and reduces ROI, while leaving higher-impact early-stage engagement underfunded.

2. Fragmented group engagement

Buying groups are not static. While senior decision makers often lead, broader members of the buying group are increasingly influencing decisions earlier in the process. By focusing only on late-stage senior stakeholders, organizations risk alienating or missing the larger group dynamic.

3. Prolonged cycles and added friction

Current B2B journeys often extend beyond a year. Engaging only those at the finish line means neglecting the early entrants who shape buying criteria. That slows consensus and adds friction later in the process.

4. Content mismatch with buyer expectations

Buyers now consume 4-6+ pieces of content per purchase decision (Voice of the Buyer, 2025). Yet most BOFU-heavy marketing only serves sales-ready needs. This creates a credibility gap, where buyers feel unsupported in earlier stages and turn elsewhere for education and enablement.

5. Neglect of TOFU and MOFU engagement

Overprioritizing late-stage intent leaves top- and mid-funnel buyers underserved. According to the LinkedIn 2023 B2B Marketing Benchmark Report by Ipsos, lead generation continues to consume the largest share of marketing budgets, yet nearly half of B2B CMOs identify finding and acquiring new clients as their top challenge, underscoring significant inefficiencies at the top of the funnel that contribute to missed conversion and growth targets. Without consistent engagement across the journey, buyers can fall out of the funnel entirely.

6. Reduced agility and foresight

Markets, ICPs, and buyer behaviors evolve quickly. Organizations that only monitor BOFU signals miss early trendlines visible in TOFU and MOFU engagement. That reactive stance erodes competitiveness and leads to misaligned tactics when conditions shift.

In short, over-focusing on the small “ready now” few may produce some short-term wins but undermine brand-to-revenue performance, buyer enablement, and sustainable pipeline growth.

Why demand generation is essential for expanding your market

Demand generation activates accounts, creates market presence, and builds preference long before buyers ever identify themselves as prospects. Without it, lead generation has nothing to capture, as lead generation is the result of successful demand generation.

Modern demand generation expands beyond awareness. It establishes brand-to-revenue impact by:

- Activating accounts across the full journey: Demand generation engages entire buying groups and not just senior decision makers. This broad engagement reduces friction in long, consensus-driven evaluations.

- Enabling buyers: It supports education and problem-framing across today’s longer buying journeys. By sustaining awareness and trust over time, demand generation ensures sales teams are not starting cold.

- Fueling the entire lifecycle: Think of the bow-tie model (depicted below). Demand generation flows into new client acquisition as well as post-sale engagement, driving retention, advocacy, and expansion.

- The market is recognizing this shift: 40% of marketers now allocate more than half their budget to demand generation (Voice of the Marketer, 2025), reflecting its critical role in long-term pipeline health.

In demand generation, core tactics such as inbound and outbound content, webinars, events, communities, social engagement, and orchestrated email marketing remain familiar. However, the approach has changed with these approaches. Demand generation today is about orchestrating those activities to reach buyers in the dark funnel, personalize the buyer journey by account and role, and enabling stakeholders at every stage.

When done effectively, demand generation expands the active market, accelerates revenue velocity, and ensures that when buyers are ready, your brand is the one they already trust.

Best practices for engaging the entire buying group

Buyer engagement is all about enabling entire buying groups across a long, complex decision cycle that spans omnichannel experiences. Effective demand generation ensures that every stakeholder has the right information, in the right format, at the right time.

Below are some best practices for engaging modern buying groups.

1. Build an accurate, evolving ICP and data foundation

Regularly audit CRM and intent sources to ensure they align with your true ICP, account priorities, and buying group structures. Enhance this with behavioral and firmographic data to understand pain points, timing, and the mix of stakeholders (directors, managers, IT, associates) shaping early-stage engagement.

2. Orchestrate omnichannel engagement with personalized value

Deliver omnichannel content personalized by account and role to create a connected experience. According to the Lead Nurturing and Acceleration Benchmark Survey, 23% of lead nurturing leaders see a 30% or more increase in sales opportunities from well-nurtured prospects, versus only 7% for those left behind. Proper orchestration ensures your message compounds across touchpoints and drives brand-to-revenue impact.

3. Design content for the entire group

Build strategic content libraries that address each role’s perspective, including strategic outcomes for leadership, tactical proof points for managers, and technical validation for practitioners. This means new stakeholders joining mid-cycle still receive relevant messaging.

4. Enable self-paced research

With buyers 70% through their journey before contacting sales (6sense, 2024), provide ungated content, interactive tools, and role-relevant resources to help prospects size problems, compare approaches, and build consensus at their own pace.

5. Deliver demand-ready content consistently

Provide stage-specific assets beyond generic resources to accelerate evaluation and enable buyers throughout the journey, preventing bottlenecks in decision making.

6. Optimize for discoverability

Use SEO to align with buyer intent and capture early research, supporting TOFU discovery and long-cycle brand preference. AI-driven search habits make Answer Engine Optimization (AEO) increasingly important, as zero-click searches accounted for nearly 60% of queries in 2024 (B2B Buyer’s Survey (2023)).

How to target TOFU and MOFU with effective buying group engagement

Effectively targeting the top and middle of the funnel involves activating buying groups early and enabling them throughout long, complex journeys. According to the 2025 Voice of the Buyer report, associates and managers are entering earlier in the process (+6.6% and +5.8% YoY growth), and most groups now take nearly a year on average to make a decision.

For effective buyer journeys, marketers must engage stakeholders at every stage.

4 Ways to engage TOFU buying groups

At the awareness stage, buyers are defining problems, gathering education, and exploring options. Effective TOFU strategies build trust, establish brand preference, and position your company as a guide before solutions are even shortlisted.

Here are four effective strategies for engaging TOFU buying groups.

Publish educational content:

Create ungated guides, checklists, videos, and explainers that clarify problems, risks, and trends

Offer interactive tools:

Use calculators, templates, and diagnostics to showcase expertise and spark early trust

Share “snackable” insights across channels:

Post short, insight-rich content on LinkedIn, search, events, and peer groups to build credibility

Highlight thought leadership:

Share original insights on industry shifts and buyer pain points to establish authority and brand preference

4 Ways to engage MOFU buying groups

At the consideration stage, groups are weighing solutions, comparing approaches, and aligning internally. Engagement here should reduce friction, build consensus, and enable evaluation.

Here are four effective strategies for engaging MOFU buying groups.

Targeted touchpoints:

Deliver role-specific emails, events, and content instead of generic cadences

Product experiences:

Provide demos, walkthroughs, and sandboxes for self-paced exploration

Real-world validation:

Use case studies and testimonials tailored to each role’s priorities

Engage communities:

Participate in forums, LinkedIn groups, and analyst discussions to build credibility

Key takeaways

- Focusing too heavily on BOFU prospects limits growth, inflates CAC, and overlooks the majority of buying groups who enter at TOFU and MOFU stages. A full-funnel, buyer-centric approach ensures all stakeholders are engaged and nurtured throughout long, complex journeys.

- Intent signals are most effective when combined with account fit and opportunity insights. Mapping them across the entire buying group enables marketers to identify truly in-market accounts while also providing the content and experiences needed to guide consensus and reduce friction.

- Modern demand generation expands market presence, builds trust, and fuels revenue by orchestrating omnichannel, role-based engagement across TOFU, MOFU, and BOFU. Consistently delivering relevant content and enabling self-paced research ensures your brand remains top-of-mind when buyers are ready to make decisions.