After analyzing your first-party database, you may find gaps in your tracking such as a lack of clarity on how buyer pain points shift across the buying journey. For example, the challenges at the top of the funnel may be clear, but as prospects reach the end of the buying cycle, there is a lack of data insights on their top challenges and how to engage them.

Conducting surveys is a simple way to engage these prospects with queries on specific knowledge gaps you would like to address. However, fielding this direct feedback requires establishing strong client relationships (and often incentivization). Client surveys should also be conducted routinely to fuel analysis and demand performance, making this a valuable strategy but also a difficult one to implement without support.

Collaborating with partners that own opt-in media ecosystems combats this issue as they are able to supply relevant, full-funnel data insights on prospect behavior, including their top challenges and their intent.

Therefore, partnering is an effective strategy for bolstering your first-party database after your own enrichment processes. Given their flexibility, partnerships are often cost-effective, agile, and can be scaled easily—to include other networks and content publications that are valuable for engaging your buyers, for example.

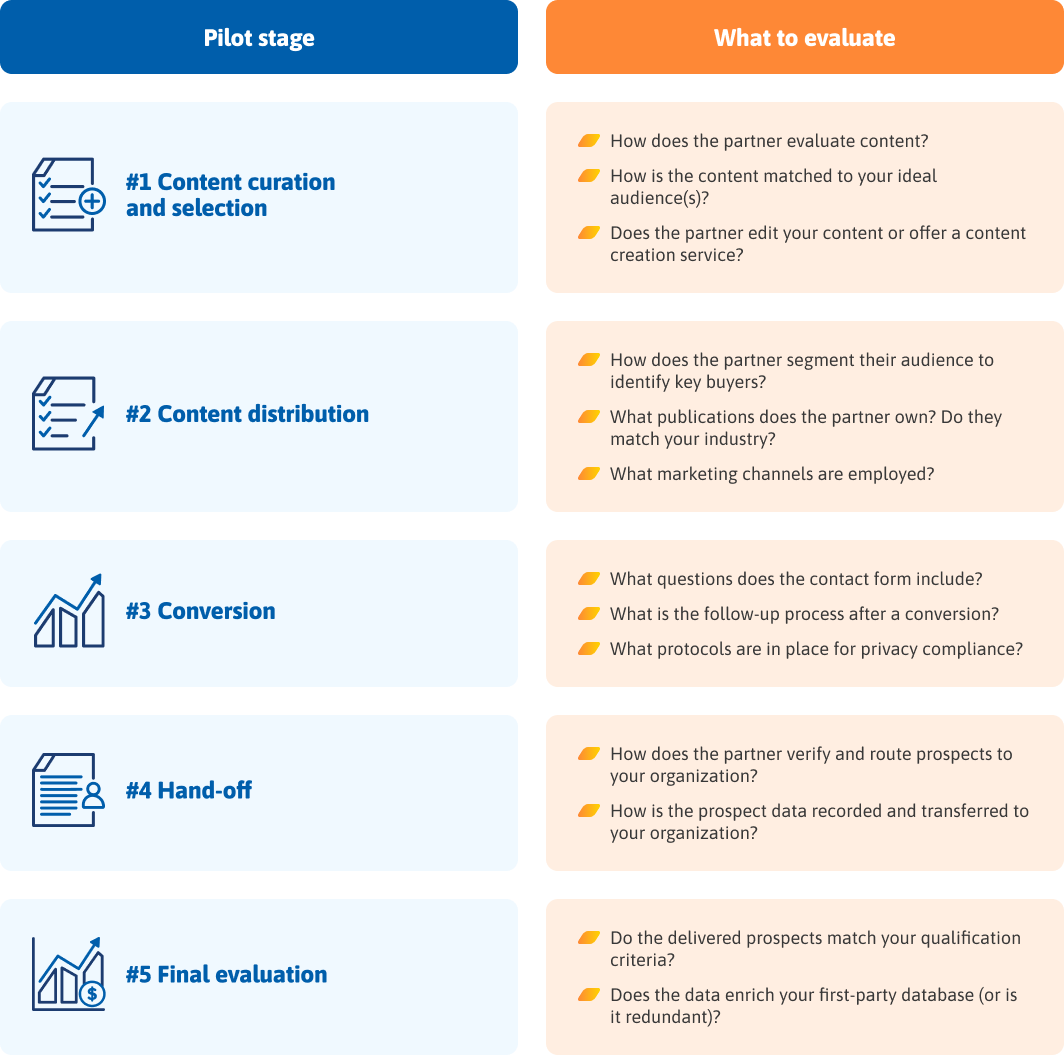

There are many B2B content distributors available, which can make it challenging to determine the most relevant one for your audience.

While most partners should share this information with you, it is valuable to have these questions prepared ahead of time (to name but a few). Guide this process by first deciding why you seek a partnership to enrich your database and demand generation strategies. This will then serve to anchor your evaluation process.