Though partnerships and the channel have driven revenue for decades now, the last couple of years have seen a shift to focus on the importance of partners and the indirect channel. This has also been accelerated by the development of the partner ecosystem, which accentuates multiple partnerships (from vendor to reseller to integrators and more) to deliver on customer needs.

Though this need has accelerated, partner marketing has not kept up. However, we are starting to see that the importance of partner marketing is becoming more recognised within vendor organisations. Partner marketers are also focused on supporting their partners with more agile, digital, trackable, and ROI-driven methods.

Despite this initiative, the smaller partner marketing teams have to tackle this challenge along with requiring support themselves to be able to assess their partners' marketing readiness and execute marketing campaigns. Ultimately in 2024, the importance of supporting partners to generate demand and ROI will be high on the agenda.

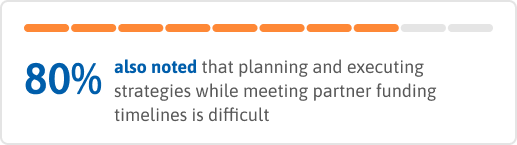

Partner marketing has noticeably shifted in its approach, predominantly driven by the need to demonstrate ROI from campaigns with partners. This has extended to how partners request MDF budgets within vendor organisations.

If you ask a partner what they want from partner marketing campaigns, their top priority will still be to generate leads. However, the need to show ROI and success from campaigns has meant that partner marketing teams are now focusing on more data-driven campaigns (ABM when it comes to demand generation efforts).

Alongside events, demand generation will be an important part of developing prospects for partners in 2024. From our experience at INFUSE, third parties offering demand generation services must understand the challenges faced by both vendors and partners and offer data-driven, flexible but also simple to execute solutions across all stages of the funnel.

There are four key challenges impacting partner marketing currently:

However, partner marketing teams often lack the time and resources to deep dive into their partners and assess their capabilities of marketing, executing, and following up campaigns. This is where expert agencies come in to support partner marketers in this area with their channel expertise (such as the fellow respondents to this roundup).

Unspent MDF is a significant pain point and frustration for everyone involved, as it can lead to valuable opportunities becoming missed. At INFUSE, we run MDF-driven demand generation campaigns managed through our agency partners or the vendors themselves, and even sometimes by working directly with partners who have received funding.

Across all of these examples, what we are finding is that when partners have contributed their own budget, they are much more engaged in the success of the campaign. These partners are also more receptive to receiving intelligence on how leads were generated and how best to orchestrate lead follow up, which is another positive of this approach.

The difficulty of this system is engaging partners, particularly those with smaller teams, who are under pressure and lack the time, resources, or skill set to create a compelling business case for applying for MDF.

With that in mind, I think the MDF model will continue to evolve and be tweaked in line with empowering partners. We are also seeing, by working with our clients, that this partner contribution method can be broached with flexibility. For example, rather than simply rewarding the top-performing partners with MDF, clients are also considering 'rising star' partners who simply require support to excel. This change is refreshing to see and a sign that the system is moving toward enabling partners of all sizes to deliver better performance.

When we launched our channel division here at INFUSE, we spoke to a lot of partner marketers to understand their challenges concerning demand generation. The key challenges were:

By understanding these critical components of demand generation programs for partner marketers, we have been able to develop solutions to successfully execute campaigns that match the experience and capabilities of each partner.

On the side of the partner marketer, resourcing is key to the challenges they face when it comes to driving the performance of campaigns. Auditing and assessing partners is critical to the success of any campaign and remains a time-consuming exercise. This is particularly true given the pressure for partner marketers to deliver campaigns and help partners drive revenue.

With that in mind, this is why channel specialists will continue to play an important role in 2024 as they are able to support partner marketers in these critical strategic areas.

Matt Dalton has over 10 years of experience in B2B technology media, having leadership roles in sales and marketing across print, events, digital media, and demand generation in the partner marketing space. Matt joined INFUSE to build and launch our specialist channel division, designed to create and execute demand gen solutions specifically for partner marketers.